Commission payroll tax calculator

Free Unbiased Reviews Top Picks. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

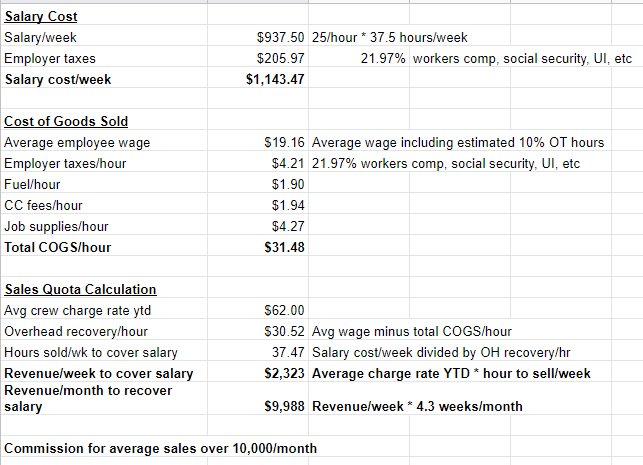

Sales Person Commission Calculator Ready Business Systems

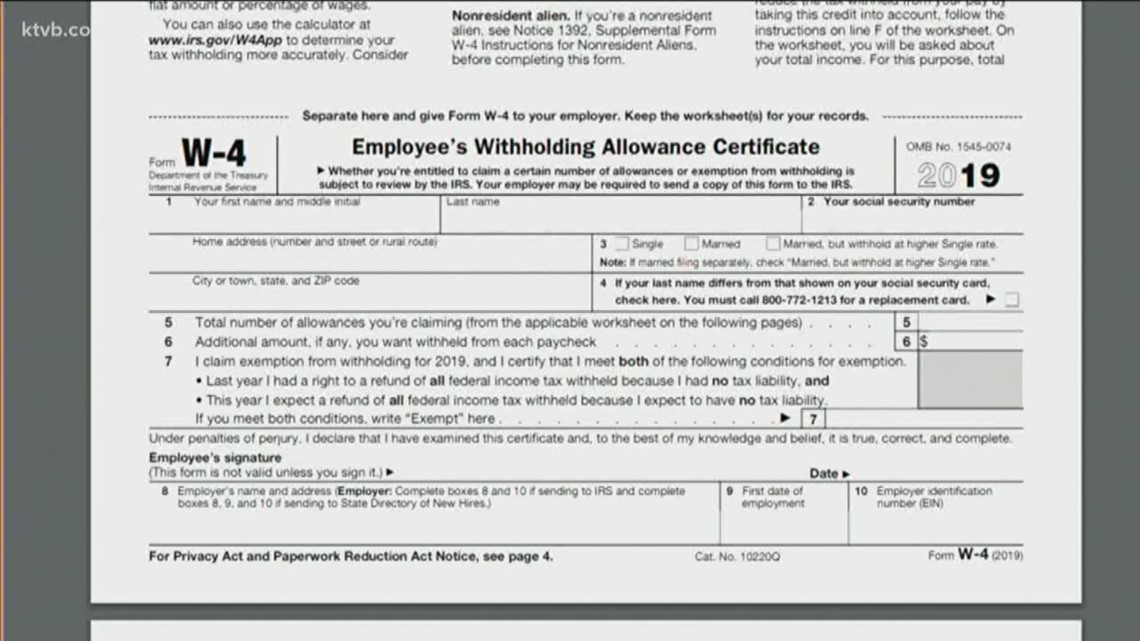

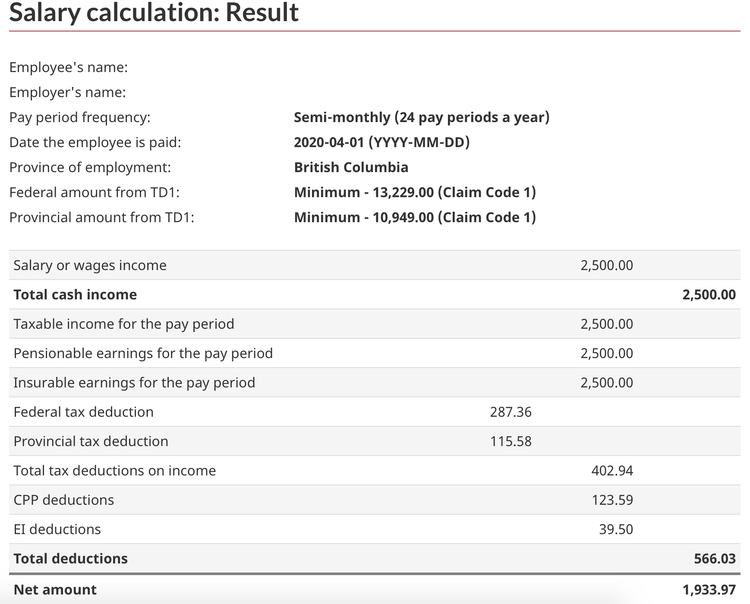

Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out a Form TD1X Statement of Commission Income and Expenses for Payroll.

. In our example its. Whether its W-4 deductions gross-up. Get an accurate picture of the employees gross pay.

To calculate their revenue we need to calculate the percentage decrease. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Commission payments and bonuses.

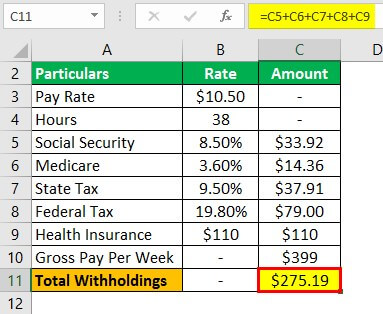

Your employer will withhold money from each of. Use our payslip calculator to check the correct tax and other deductions have been made fully updated for tax year 2022-2023. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing.

Use the Free Paycheck Calculators for any gross-to-net calculation need. If youre looking to calculate payroll for an employee or yourself youve come to the right place. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

What does eSmart Paychecks FREE Payroll Calculator do. Ad Compare This Years Top 5 Free Payroll Software. If you receive it outside your regular paycheck then it becomes supplemental and your commission is taxed at a rate of 25.

Plug in the amount of money youd like to take home. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Employers are still required to withhold Social Security. Free Unbiased Reviews Top Picks. Free salary hourly and more paycheck calculators.

Real_revenue sale_price - sale_price commission_percentage 100. Ad Compare This Years Top 5 Free Payroll Software. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4.

Important note on the salary paycheck calculator. Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

8 FREE payroll calculators for you and your employees.

Free Paycheck Calculator Hourly Salary Usa Dremployee

Payroll Calculator Free Employee Payroll Template For Excel

Sales Commission Calculator Spreadsheet Check More At Https Onlyagame Info Sales Commission Calculator Spreadsheet Excel Templates Sales Template Templates

4 Free Sales Commission Spreadsheets Templates Sales Commissions Explained

Idaho Tax Commission Offers Help Calculating Withholding Ktvb Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Payroll Formula Step By Step Calculation With Examples

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

How To Do Payroll In Canada A Step By Step Guide

4 Free Sales Commission Spreadsheets Templates Sales Commissions Explained

Paycheck Calculator Take Home Pay Calculator

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How To Calculate Commission Of Different Types Traqq

Nvai7b73uqmw5m

Paycheck Calculator Take Home Pay Calculator

Calculate Tax Amounts