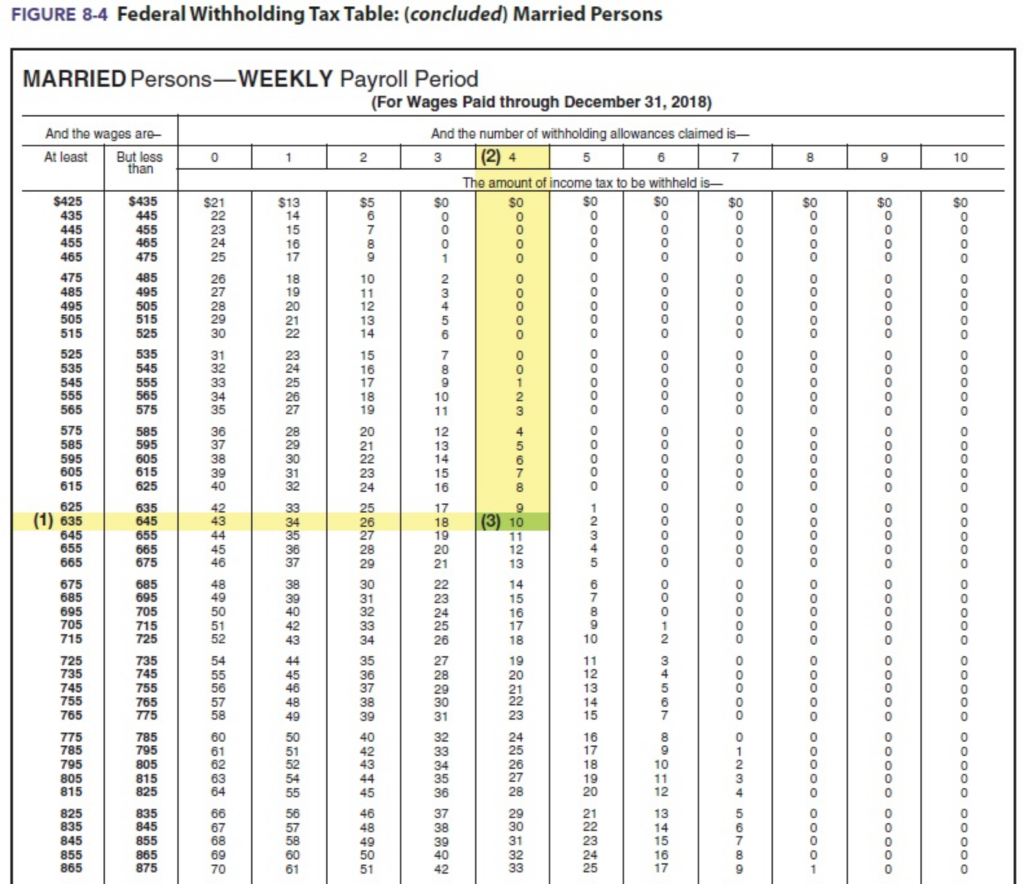

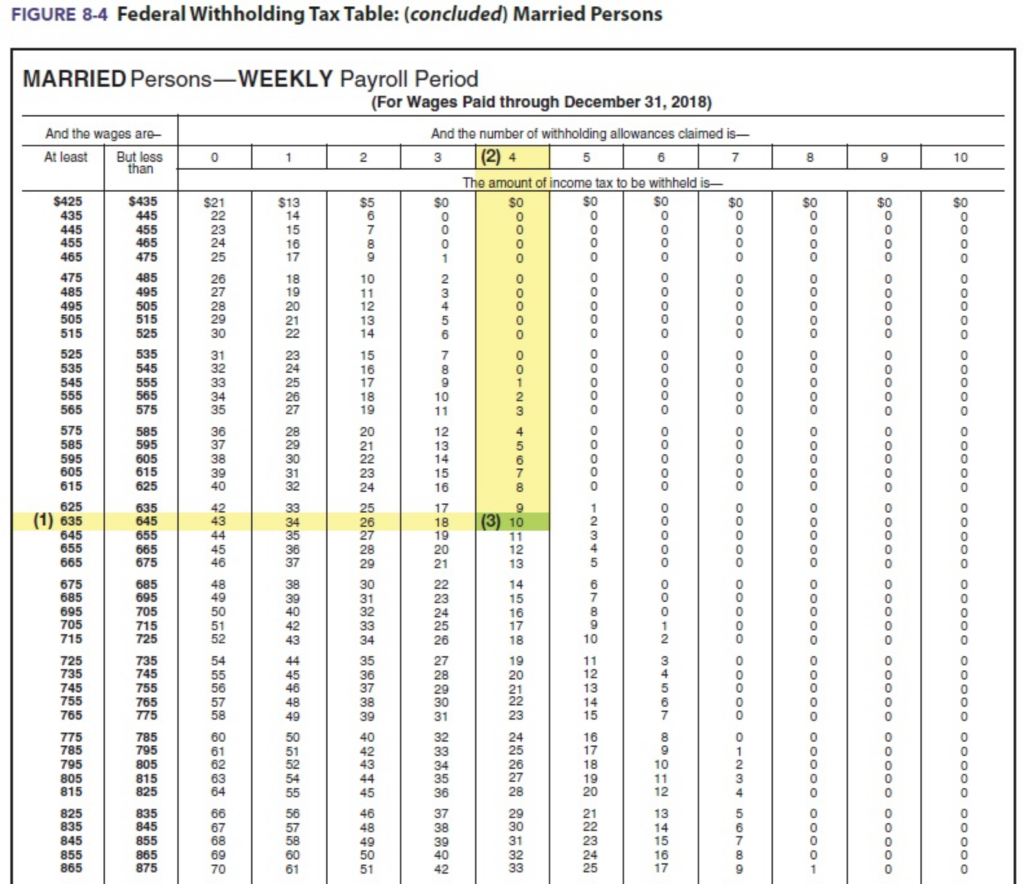

Figure federal withholding

How to Check Your Withholding Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Computing Federal Income Tax Using The Table Chegg Com

Lets call this the refund based adjust amount.

. Ready to get your tax withholding back on track. Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2022. Sign Up Today And Join The Team.

Withholding allowances were exemptions that employees used to use to claim from federal income tax using Form W-4. Total Up Your Tax Withholding. Five to 10 minutes to complete all the.

The amount of income tax your employer withholds from your regular pay depends. Use an employees Form W-4 information. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

250 minus 200 50. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Get the Latest Federal Tax Developments.

Ad Search For Answers From Across The Web With Topsearchco. Learn About Payroll Tax Systems. Your W-4 calculator checklist.

Discover The Answers You Need Here. How to Calculate and Adjust Your Tax Withholding. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

250 and subtract the refund adjust amount from that. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Complete a new Form W-4P Withholding Certificate for Pension.

Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Plan to pay taxes on 9235 of your net earnings. Ad Accurate withholding repotting to federal state and local agencies for all transactions.

The federal withholding tax rate an employee owes depends on their. Federal withholding tables determine how much money employers should withhold from employee wages for federal income tax FIT. Added to your income tax liability is.

Automate manual processes and eliminate human error with Sovos tax wihholding solutions. If youre exempt from withholding meaning you didnt pay any federal income taxes last year and dont expect to owe any this year you can choose not to have any. Get the Latest Federal Tax Developments.

Be sure that your employee has given you a completed. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer. 10 12 22 24 32 35 and 37.

Withholding allowances were used to determine an. Use the Tax Withholding Estimator on IRSgov. Then look at your last paychecks tax withholding amount eg.

Youll need your most recent pay. For employees withholding is the amount of federal income tax withheld from your paycheck. Figure out which withholdings work best for you with our W-4 tax withholding calculator.

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Net earnings are your gross business earnings minus trade and business expenses. The federal withholding tax has seven rates for 2021.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. IR-2019-155 September 13 2019 WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov includes user-friendly features designed to help.

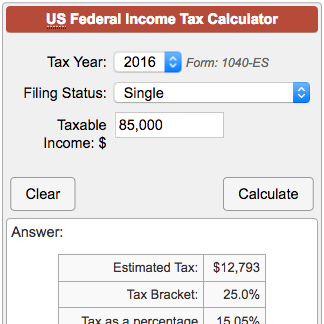

Federal Income Tax Rate Calculator Factory Sale 53 Off Www Wtashows Com

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Federal Tax Calculator Flash Sales 55 Off Www Wtashows Com

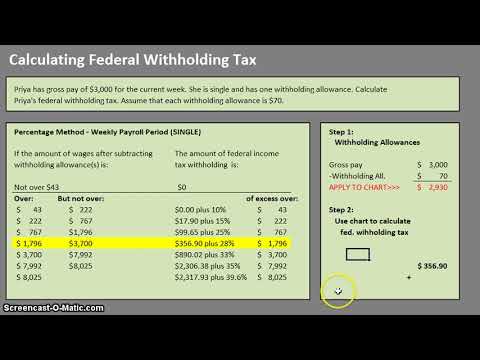

How To Calculate Federal Withholding Tax Youtube

Calculation Of Federal Employment Taxes Payroll Services

Excel Formula Income Tax Bracket Calculation Exceljet

Federal Income Tax Calculator Flash Sales 57 Off Www Wtashows Com

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate 2018 Federal Income Withhold Manually

Tax Withheld Calculator Shop 57 Off Www Wtashows Com

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Federal Income Tax Fit Payroll Tax Calculation Youtube

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate Federal Income Tax